This is Part 2 of The Material Evolution of Digital Currency to Crypto series. You can find Part 1 here.

The Great Recession Gave Birth to Bitcoin

In case you missed it, back in late 2007, the US subprime mortgage market collapsed and brought down with it banks around the world causing the Great Recession, the most severe economic and financial meltdown since the Great Depression. For those of us around during that time, it was a period defined by a marked increase in distrust of State and financial institutions manifested by the Occupy Wall Street protests and distress caused by economic uncertainty. This was also just before the original bitcoin white paper was published.

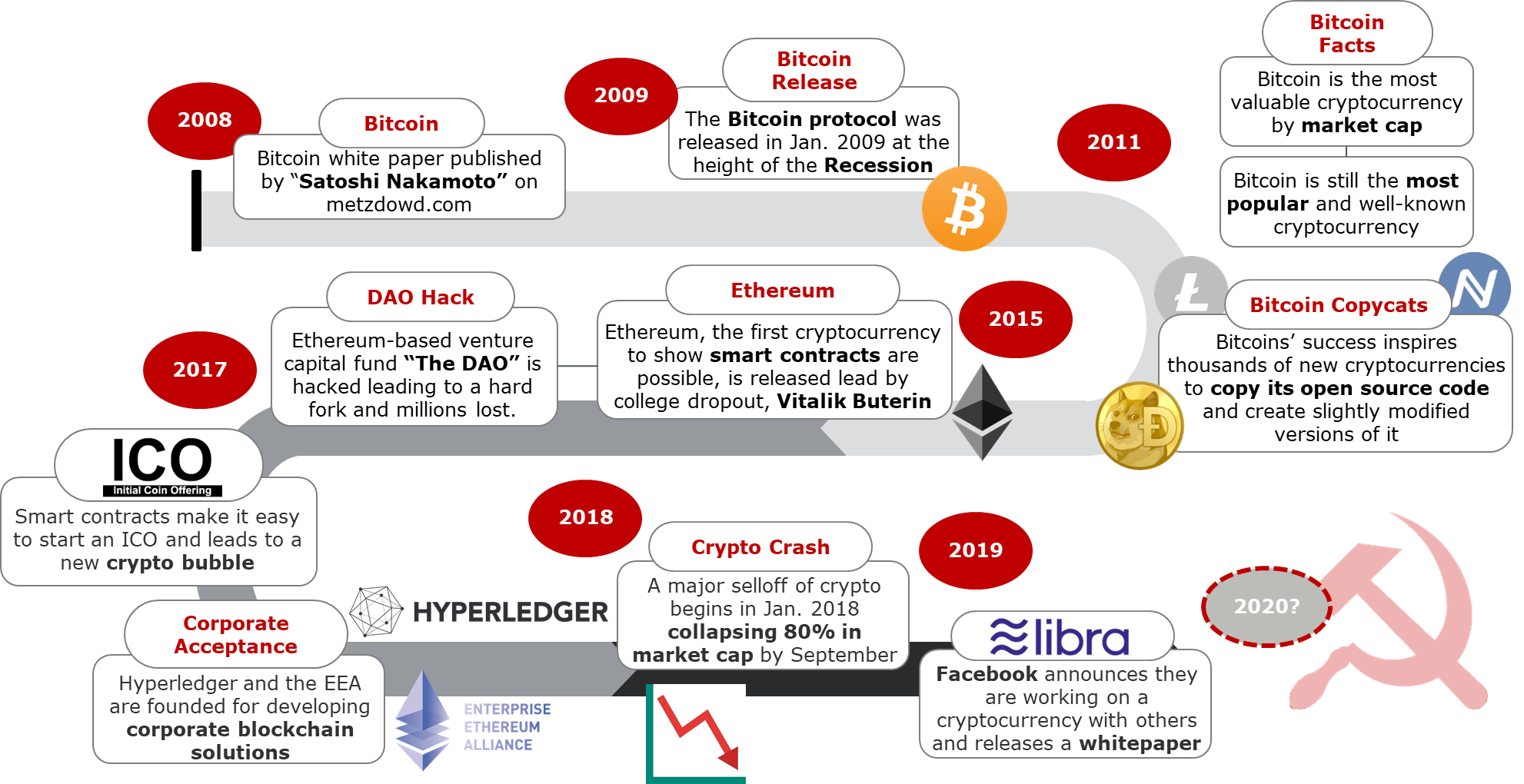

The bitcoin story starts on October 31st, 2008 when a paper authored by a “Satoshi Nakamoto” was posted on a cryptography mailing list called “Bitcoin: A Peer-to-Peer Electronic Cash System.” It described a value transfer system that was not reliant on a 3rd party or central authority like Western Union or any other financial institution by using the internet. If it worked, we wouldn’t need to trust the same banks that screwed us over to make money from gambling on subprime mortgages to hold our money. Of course, it’s easy to say now that it was a utopian thought considering all the issues that weren’t thought about that needed to be addressed before bitcoin could be adopted widely enough to be a currency, but that was the initial idea.

A bourgeois analysis of what happened during the Great Recession

Bitcoin came to be because of the material conditions in which we found ourselves at that time. First, all of the cryptographic technology already existed to make it. It just needed to be arranged in such a way that made it bitcoin. In fact, very similar technology was already used in banking to secure their own centralized digital currency ledgers to make money through complex financial instruments like AAA-rated collateralized debt obligations that turned out to be bunk.

Second was the psychological effect of witnessing the world’s largest banks go under due to their own greed while still receiving massive bailouts from the government since they were “too big to fail.” The cracks in the system were on full display and the contempt for the working class as well. Wasn’t there a famous bearded German who said that one of the contradictions of capitalism was that as it develops, it creates the material conditions for its own undermining leading to the working class breaking its chains to the capital-owning class and the development of socialism? I forget his name.

I just cannot remember his name for the life of me

These two things along with some inspiration from the Cypherpunk Manifesto inspired the creation of bitcoin and the thousands of other cryptocurrencies that came after it. In dialectical terms, the thesis, represented by corrupt corporate capitalism relying on trust in centralized institutions, gave birth to its proposed antithesis, bitcoin which offered a “decentralized” alternative. This is not to say that bitcoin is the opposite of banking (what the hell would the opposite of banking even be?) but it proposed an escape from the perceived enemy at the time being financial institutions and the State.

After the initial launch of the bitcoin protocol in 2009, the people who knew about was restricted to a small group cryptography nerds located throughout the world. In the beginning, it was simply a fun way to send internet points to one another for not reason until 2010 when one user of the bitcoin network offered to give 10,000 bitcoins to someone else if they ordered two pizzas to their house. What has been called now the two most expensive pizzas bought in the world, finally got the ball rolling because now, bitcoin had a price attached to money.

Later in 2010, Mt. Gox launched the first bitcoin exchange where users could buy and sell bitcoin with the fiat money that they held at the same banks they hated so much. In just three years, the site was handling over 70% of all bitcoin transactions on the network. The fun didn’t last long when in 2014 the company decided to halt all activity due to financial insolvency when they learned they lost over 700,000 bitcoins. The site’s owner, Mark Karpelès, was found guilty on charges of embezzlement of the bitcoin in Japan. So far, not much for creating an alternative that would prevent stealing from well-behaved investors as they still depended on a centrally owned exchange to trade bitcoin.

Things aren’t so decentralized when you need to trust your bitcoin with this fucker

The Post-Bitcoin Age

After the creation of bitcoin, it didn’t take long for similar projects to come to fruition on the premise that they were the same but technologically superior in one way or another. For example, Litecoin was created by ex-Google employee Charlie Lee in 2011 as an altcoin (an alternative to bitcoin). To make Litecoin, Charlie largely copied the code for bitcoin and changed the block time (time to process recent transactions) from 10 to 2.5 minutes and slightly modified bitcoin’s proof of work algorithm. Easy money baby! Nowadays Litecoin is used as a testing ground for new applications and proposed changes to bitcoin.

At this point in time, it has essentially been confirmed that blockchain technology can be used to facilitate some form of value exchange using just computers and the internet. Knowing this, it isn’t a stretch to say it could be possible to tell computers to perform a value transfer based on predefined conditions. We call these smart contracts in Crypto World. If you want to learn more about how they work, you can check out an article here where I write about it a bit.

In 2014, a Canadian student studying computer science named Vitalik Buterin dropped out of McGill University to pursue building Ethereum. The previous year he had published the Ethereum whitepaper titled “A Next Generation Smart Contract & Decentralized Application Platform.” It proposed way to use blockchain technology, like that used in bitcoin, to make a smart contract platform. So using his Thiel Fellowship (yes, as in libertarian billionaire Peter Thiel) money he gathered a few more like-minded individuals to build it and released the initial protocol in 2015. Long story short, they prove that you can make smart contracts using blockchain. However, two years later they learned that sometimes smart contracts actually aren’t too smart sometimes.

His meme dedication is on another level but I guess that that’s the shit you can pull as a crypto celebrity

In 2017 the Ethereum-based investor-directed venture capital fund, “The DAO,” had millions of dollars’ worth in ether (the cryptocurrency for the Ethereum platform) held in smart contracts stolen after their crowdfunding campaign. It turns out that if you make programming errors in your smart contract, computers aren’t going to know that it shouldn’t give all your money to black hat hackers. As you can imagine, investors were pissed and it sparked an intellectual debate of sorts. Under the logic of laissez-faire capitalism, the investors deserved losing their ether for making a risky decision to trust the code in the smart contracts. The event really showed who the “real” crypto libertarians were.

The conflict caused a hard fork or a split in the network where one group of nodes decided to stay on the same Ethereum blockchain that lost all of the ether and another group decided to reverse the losses to investors and start a new Ethereum network that began again right before the hack happened. The original blockchain with the hackers owning the stolen ether became Ethereum Classic and the new one, led by Vitalik, kept the name Ethereum. It’s pretty amazing as a Leftist to learn about this event where the contradiction of the libertarian ideology comes to the fore isn’t it? At this point in time, we can see that the less fundamentalist Ethereum has clearly beaten out Ethereum Classic in development progress and market cap.

If we recall my crude dialectical analysis from before, we had our corporate capitalism thesis and bitcoin antithesis, but we can’t have these without our synthesis of even more contradictions. In 2017, during the ICO craze, which I talk about in an article here, two organizations were started specifically to make blockchain solutions for the very corporations that were so hated when we started this whole thing.

The Enterprise Ethereum Alliance (EEA) was founded as a non-profit with members including blockchain startups and Fortune 500 companies in order to build solutions on Ethereum for these large companies. Hyperledger was founded by the Linux Foundation to create open source blockchain tools for corporate solutions and receives most of its funding from companies like IBM who then consults companies on building proof of concepts with Hyperledger based tools. It’s like some weird corporate incest circle.

Now is as good a time as ever for a Leftward push in the crypto space to counter corporate influence

The reason I think it’s important to know a little bit about the corporate side of blockchain is because it shows that ~neoliberalism~ even has its greasy fingers influencing a space originally meant to represent an alternative to corporatism. It also signifies that the corporate elite are looking to incorporate blockchain into their own institutions so to preemptively counter blockchain projects that would hurt their position. We see this as well with Facebook’s announcement of their bastardized blockchain solution Libra.

History shows that this unholy synthesis can be a real threat to the working class and is not something the Left should take lightly. The truth is that bourgeois forces are working to continue to financialize more of our lives to increase profits and if blockchain can do it better than the current system, you can bet that they will try to do it. Bitcoin has been around for over 10 years dominated by reactionary politics and we have yet to see a significant move by the Left in the crypto space. I implore others on the Left to consider these future threats and to doing what you can to make 2020 a year for exploring more ways for the Left to use blockchain to promote class-consciousness and structures for expressing solidarity with the working class.

If you liked the article and want to be sure that you see more content like this, please sign up for the Newsletter, follow me on Twitter (@TBSocialist), and join the r/CryptoLeftists subreddit. Also, I will never allow advertisements on my site so if you have the means to do so, please consider donating to my Patreon.